A Counterpoint to the PCAST Recommendations

The recent PCAST recommendations contain important errors that decision-makers should recognize before moving forward with regulatory changes in hearing healthcare

Reprinted with permission from The Hearing Review. Published on January 15, 2016

The author believes that OTC/DTC hearing aids have their place. However, for the majority of adults with mild-to-moderate age-related hearing losses, a guided process including fitting verification and auditory rehabilitation is needed to achieve maximum benefit with amplification. Consumers with mild-to-moderate age-related hearing losses should be directed toward those professional care practices that offer these services, not away from them. Here’s a point-by-point argument against the PCAST’s recent conclusions and recommendations.

As its name implies, the President’s Council of Advisors on Science and Technology (PCAST) exists to provide our executive branch of government with expert counsel on scientific and technological issues pertinent to the American public. In their October letter report to the President,1 PCAST laid out their views regarding hearing technology and the existing mechanisms for its delivery and use. Based on those views, they offered the President certain recommendations, including modifications to existing and proposed FDA regulations regarding hearing aids and personal sound amplification products (PSAPs) and suggestions that consumers with mild-to-moderate age related hearing loss are particularly suitable for self-diagnosis and treatment.

Since documents such as these are created to direct the thinking of key influencers within our government, their importance cannot be understated. However, it is likely very difficult for anyone not immersed in this industry or profession to see beyond the conclusions PCAST has drawn to a deeper picture, and therefore, a deeper understanding of the circumstances this letter is intended to influence.

It is from this perspective that the following counterpoints to several of the key conclusions articulated in the PCAST letter are offered. Hopefully, these counterpoints will provide others who read the PCAST letter with some additional perspective and understanding.

1) “PCAST believes that cost is the largest barrier to hearing technology adoption” (PCAST letter, page 1, italics added).1

PCAST CONCLUSION: By stating that cost is the “largest” barrier, the implication is that all other barriers are collectively smaller.

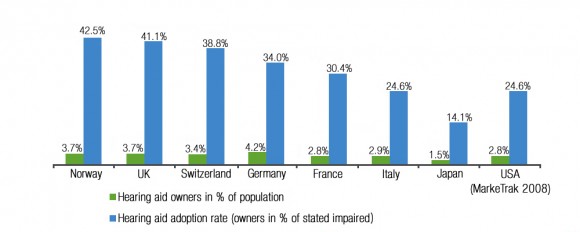

Figure 1. Hearing aid adoption rates by country from Hougaard et al.1 Green bars represent the percentage of people who own hearing aids in each country; blue bars represent the percentage of people with a self-admitted hearing loss who own a hearing aid (n=11,517, excl US).

COUNTERPOINT: This is not true. In Norway and the UK, where hearing aids are offered for free to those who could benefit from them, adoption rates (percentage of people with hearing aids versus those with self-stated hearing loss) are 42.5% and 41.5% respectively (Figure 1).2 Clearly over half of the population in these countries who have self-reported hearing loss and could get hearing aids for free still choose not to use them. When cost is eliminated as a barrier, all other barriers combined appear to eclipse cost as the reason for low adoption rates.

2) PCAST states that “Compared with other kinds of consumer electronics…hearing aids have not experienced the dramatic reductions in price and increases in features that have been routinely seen across consumer electronics” (page 2).1 PCAST then uses today’s smartphones as a comparison.

PCAST CONCLUSION: Hearing aids are “consumer electronics” and should be compared accordingly.

COUNTERPOINT: From this perspective, it would appear that pacemakers and insulin pumps are “consumer electronics,” as well; these are also electronic devices designed to assist in health matters. But, by presumptively identifying hearing aids as “consumer electronics,” readers are directed not to consider these devices as healthcare devices. In so doing, this allows comparisons to other consumer electronics such as smartphones.

This comparison is patently inappropriate. As an example, in just the fourth quarter of 2014, Apple alone sold 69 million smartphones.3 In the entire year of 2014, the collective global hearing aid industry sold approximately 12 million devices.4 Simple business math would readily conclude that the unit cost of a smartphone should and would be lower than the unit cost of a hearing aid (or many other healthcare electronic devices) because the cost to design, produce, and distribute the product can be spread across a much larger consumer market. This is also why actual “consumer electronics” prices can go down over time. As consumption levels dramatically grow, costs can be spread across a greater sales volume, thus lowering per unit costs (and further increasing sales volume).

Such large consumptive volumes are not available to the hearing healthcare industry. Even if the worldwide hearing aid market penetration were 100%, there are an estimated 360 million people globally who have disabling hearing loss.5 In 2014 alone, nearly 1.2 billion smartphones were sold worldwide.6 Thus, the comparison is inappropriate. However, there is a valuable take-away from this discussion: When it comes to cost, volume matters.

3) In arguing against the need for a professional examination prior to hearing technology treatment, PCAST contends that despite the prevalence of glaucoma (3.5% of population) and cataracts (35% of adults ages 70-74), “older adults are not prevented from ‘mistakenly’ purchasing over-the-counter reading glasses” (page 5).1 It is for this reason that the prevalence of acoustic-neuroma (less than 1% of the population) and ear-wax should not prevent adults with “bilateral, gradual-onset mild-to-moderate age-related hearing loss” from self-diagnosing and treating as well.

PCAST CONCLUSION: Because it is OK for older adults to mistakenly purchase over-the-counter (OTC) reading glasses, it is OK for adults with bilateral, mild-to-moderate, age-related hearing loss to mistakenly purchase OTC hearing devices.

COUNTERPOINT: This conclusion ignores the following relevant facts:

- The only OTC vision products available are reading glasses. As such, the only vision condition available for self-diagnosis and treatment is hyperopia (farsightedness). This represents, at most, 5-10% of the population.7

- For the remaining 60% of the population8 who either have myopia (nearsightedness) or who need bifocals, an examination by an optometrist prior to corrective lens treatment is not just recommended, it is required, despite the above-stated low prevalence of glaucoma and/or cataracts. In fact, in most states, such examinations must be repeated if a prior corrective lens prescription is older than 3 years before a new prescription can be filled.

Therefore, for the following reasons, it is erroneous to suggest that either of the above two facts compare with or justify in any way the recommendation that adults with bilateral, mild-to-moderate age-related hearing loss should self-diagnose and self-treat:

- Only 3.4% of Americans with hearing loss have a severe or profound loss.9 Thus, approximately 95% have mild-to-moderate hearing losses. They represent a far greater population of hearing losses and conditions than the 5-10% of the vision population that can self-treat for just hyperopia. The magnitude and prevalence of the hearing conditions being identified in the PCAST letter as self-treatable is substantially different than the magnitude or prevalence of the hyperopia vision condition being presented as a comparable justification.

- The mild-to-moderate hearing losses identified by PCAST as self-treatable specifically include those with age-related etiologies. These conditions are overwhelmingly sensorineural—not peripheral conditions such as hyperopia—and are more complex conditions to properly treat than hyperopia. Sensorineural hearing losses can include dysfunction of inner ear hair cells, the auditory nerve, and or auditory brainstem/brain pathways. And, age-related hearing conditions are further complicated by altered brain maps.10

- If the PCAST report is going to question the efficacy of a professional examination preceding approximately 90-95% of today’s hearing loss/amplification treatment scenarios, then they should not use as their example a vision healthcare model that requires such an examination repeatedly in conjunction with over 90% of corrective lens treatment scenarios.

4) “It is unclear how well [the current distribution options available] are helping consumers find hearing aids that improve their hearing” (page 4).1 As one tool to support this statement, PCAST referenced the data regarding misfit hearing aids from the 2009 Consumer Reports article.11

PCAST CONCLUSION: Since it is “unclear” to the authors of the PCAST report just how effective the current professional hearing care model can be in improving hearing with amplification, then its overall effectiveness must be suspect.

COUNTERPOINT: First, it would appear that actual consumers have no such lack of clarity. According to the latest MarkeTrak data,12 95% of hearing aid owners and 87% of non-hearing aid owners are satisfied with the care they have received from hearing care providers within the last 5 years. Ninety-one percent (91%) of consumers who have obtained hearing aids within the last year are satisfied with their hearing aids, 77% for hearing aids purchased 2-5 years ago, and 74% for hearing aids obtained 6 or more years ago. Overall satisfaction with the current hearing care model went from 75% in 2008 to its current level of 81%.

Second, in the very same Consumer Reports article PCAST has referenced,11 a strong statement regarding the effectiveness of real-ear measurement, including a quote from Todd Ricketts stating “there is evidence that you get a better fitting with a real-ear test and people are more satisfied,” is ignored. To assist PCAST authors and others, in the references section of this article are 17 professional publication references13-29 not included in the PCAST list of references, most from peer-reviewed journals, that attest to both the effectiveness and importance of real-ear measurement in securing the best possible hearing aid outcomes—a professional skill and fitting tool not available to any consumer self-treating or buying over the counter. In fact, the Consumer Reports article strongly encourages consumers to consider real-ear measurement as a “must have” when pursuing hearing aid treatment. Why would PCAST not acknowledge this valuable information in their report to the President?

And why would PCAST ignore the “Close Up” sidebar included in the very same Consumer Reports article that examined several non-prescription (over-the-counter) products, finding them all lacking on several important functional and performance levels meaningful for optimal amplification benefit when compared to “prescription hearing aids”?

5) “There is considerable evidence that hearing aids can be profitably sold for a fraction of today’s end-user costs” (page 2).1 To support this statement, PCAST uses as examples the Veterans Administration (VA), which accounts for approximately 20% of all hearing aids dispensed in the United States (for costs of about $400 per unit) and Costco, which now accounts for about 10% of all hearing aids sold in the United States, and sells products for about one-third of the typical retail price.

PCAST CONCLUSION:The only way to similarly reduce costs to a greater population of consumers is through OTC/direct-to-consumer (DTC) products.

COUNTERPOINT: By not exploring why hearing aids are wholesaled to the vast majority of hearing care providers at prices significantly higher than they are wholesaled to the VA or Costco, PCAST facilitates their singular conclusion that OTC/DTC products are the only alternative retail cost-lowering answer. This is simply not true.

In fact, PCAST acknowledges in its own argument that the purchasing volumes of the VA and Costco greatly reduce costs. The VA is one entity negotiating price based on the purchasing power of hundreds of hospitals; Costco is one entity negotiating price based on the purchasing power of hundreds of stores.

The “take-away” cited earlier in this article bears repeating: When it comes to cost, volume matters. Manufacturers agree to substantially lower their price to such large volume customers as the VA or Costco because, in so doing, they secure thousands of units a month in business. However, the majority of the sales these same manufacturers enjoy at much higher profit margins do not come from customers like the VA or Costco; they come from thousands of small businesses such as the private practices of audiologists and hearing aid specialists, ENT clinics, hospitals, and universities. None of these customers get VA or Costco pricing because none of these individual customers represent thousands of units a month in sales.

And the price differential is substantial. Quite literally, the current wholesale pricing model in the hearing industry is forcing the consumer to pay a substantial penalty when purchasing essentially the same products from small business providers. Why is PCAST not aware of or acknowledging this?

So, rather than stating hearing aids can be profitably sold for a fraction of today’s end-user costs through some providers, and then immediately jumping to OTC products as the only solution to lower costs for a greater number of consumers, PCAST should be shining a spotlight on the wholesale pricing disparity that exists in this industry, and encouraging independent healthcare professionals to form a group purchasing organization (GPO)—just as many hospitals and other healthcare entities have done to lower their costs—and in so doing, lower the cost of hearing aids currently being imposed on the single largest professional network providing them: small businesses that are the backbone of this country.

6) “The hearing aid industry is highly concentrated and lacks the steady influx of new innovative companies” (page 2).1 A similar criticism was leveled by ADA in their recent published response to HIA’s concern about ADA’s role in establishing and profiting from EarVenture, a hearing aid manufacturing enterprise.4,30

PCAST CONCLUSION: A concentrated industry is a bad thing, and by default, stifles competition and innovation. Both the PCAST and ADA publications have used as supporting evidence the statement that the “Big Six” hearing aid manufacturing corporations have for the last 10-15 years collectively garnered approximately 98% global market share.

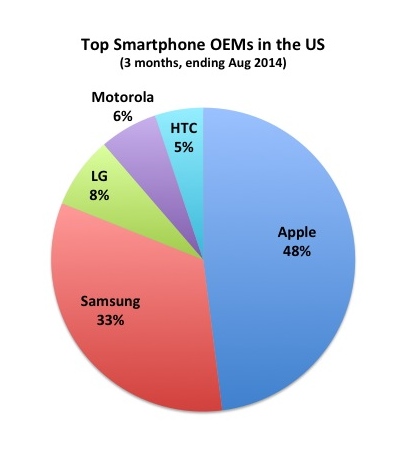

COUNTERPOINT: To be fair, this kind of concentrated climate is not unique to the hearing aid industry. Since consumer electronics and, more specifically, smartphone technology was previously used by PCAST to form their criticism of hearing aid unit cost, let’s use it again here. Figure 2 shows the third-quarter 2014 US market share distribution based on smartphone manufacturers.31 If you count the pie slices, you will see there are five. So, there are five dominant manufacturers in an industry hundreds of times larger than the hearing aid industry. Obviously, concentration is not unique to the hearing aid industry; it is certainly not unique to the medical device industry.

Now, let’s examine how such concentration may be stifling innovation or competition. Here are just three examples of hearing aid manufacturing companies that are not part of the Big Six, and that are currently bringing unique innovations to the hearing aid industry, including in the United States:

- Audina offers a variety of RIC, thin-tube, BTE, and custom products with innovative ergonomic designs, unique nano coatings to protect from moisture, and high-end technology at very competitive price points in comparison to the Big Six.

- Sebotek offers a RIC product line with a unique articulating receiver coupling design that can be bent and angled to accommodate a large variety of ear canal anatomies, and a unique, very soft and comfortable set of domes that facilitate deeper insertion into the ear canal, resulting in broader bandwidth delivery, minimal occlusion effect, and a more gain efficient acoustic environment. Again, very competitive price points.

- ExSilent offers a RIC product line that incorporates both the microphone and the receiver into the componentry that rests in the patients ear canal, thus allowing the natural pinna and canal directionality properties to be part of the amplification experience.

More of these companies exist. Hansaton is a successful company that helped innovate and promote rechargeable hearing aid technology, and was recently purchased by Sonova. This type of small-company technology development and acquisition is a hallmark of innovative, fast-moving industries. (Similarly, companies like ZPower, HyperSound, and SoundCure are carving out unique niches with innovative complementary products.)

It should be acknowledged that these companies have small market shares when compared to the Big Six global manufacturers. However, the reason for this is likely not because competition is being stifled by the larger manufacturers. If the Big Six were deliberately trying to eliminate such competition, why wouldn’t they be pricing these smaller competitors out of the market? Clearly, they are not. Indeed, these smaller companies are often the ones offering the lower prices.

The reason is more likely because the majority of the existing providers are choosing to purchase virtually all of the products they fit from the Big Six, often at higher cost, without ever exploring or experimenting with these other offerings or new technologies. If the argument of these providers is that they don’t have enough time, or they don’t want to learn new software, then frankly, they are justifying PCAST’s recommendation to bypass them. It is the professional’s responsibility to secure not only the best products for their patients, but at the best possible value, regardless of the time or effort it takes to do the research or learn the technology. Since the success (both in market share and profits) the Big Six currently enjoy is due in no small measure to the purchasing choices smaller hearing healthcare providers make, and the prices they are willing to pay by not buying together, pointing a finger at the Big Six for their success includes pointing three fingers at the providers who are making these purchasing decisions.

Figure 2. US market share of smartphone manufacturers. Although PCAST and others go to great lengths pointing out the hearing industry’s dominance by the “Big 6” manufacturers, most mature high-tech industries—including the global 1.2 billion units-per-year smartphone industry (compared to the global 12 million unit hearing aid industry)—are dominated by only a few large players.

Final Thoughts

The issue that “cost matters” has been reported on and described repeatedly for over a decade by the author.32 As potential thought leaders such as PCAST and disrupters such as PSAP manufacturers and Big Box stores draw more attention to cost as a consumer issue, it has now become “vogue”—at least from the perspective of “entry-level” products and prices—for others within our profession to start recognizing and championing the importance of wholesale cost as well. However, from the consumer perspective, the issue of cost is not limited to the “entry-level” market. For consumers, cost is an issue that exists across all hearing treatment products and indeed across all professional services. And, the challenges this cost issue represents are felt most acutely within small hearing care businesses that continue to pay the most for virtually identical products consumers can purchase from other sources.

PCAST should have recognized this key fact in their research, and should have championed efforts to sustain small business enterprises in hearing care, rather than throwing them out (for mild-to-moderate age-related conditions) with the “high-cost” bath water. PCAST should be both recognizing the cost disparities within the current hearing care distribution model that burden small provider businesses, and encouraging those small provider businesses to operate within a GPO structure that can meaningfully lower those costs. And, PCAST should be championing HR2519,33 which addresses key cost and accessibility issues for Medicare recipients when it comes to their hearing health.

There is certainly a role that OTC products can play. However, like cheaters (reading glasses) for hyperopia, OTC hearing devices should be restricted in terms of the conditions and etiology they are equipped to accommodate—perhaps to individuals who either have only a slight hearing loss, or who want just a little hearing help without the need (yet) for professional assistance. Certainly, for adults with mild-to-moderate age-related hearing losses which are likely long-standing and sensorineural, a guided process including fitting verification and auditory rehabilitation is needed to achieve maximum benefit with amplification. Consumers with mild-to-moderate age-related hearing losses should be directed toward those professional care practices that offer these services, not away from them.

References

- President’s Council of Advisors on Science and Technology (PCAST). Aging America & Hearing Loss: Imperative of Improved Hearing Technologies [letter report to President Obama]. October 26, 2015. Available at: https://www.whitehouse.gov/sites/default/files/microsites/ostp/PCAST/pcast_hearing_tech_letterreport_final.pdf

- Hougaard S, Ruf S, Egger C. E EuroTrak + JapanTrak 2012: Societal and personal benefits of hearing rehabilitation with hearing aids. Hearing Review. 2012;20(3):16-26. Available at: http://www.hearingreview.com/2013/03/eurotrak-japantrak-2012-societal-and-personal-benefits-of-hearing-rehabilitation-with-hearing-aids

- Bora K. Apple iPhone Sales 2014: UBS data suggests 69 million iPhones sold in December quarter. Jan 8, 2015. Available at: http://www.ibtimes.com/apple-iphone-sales-2014-ubs-data-suggests-69-million-iphones-sold-december-quarter-1777070

- Kirkwood D. Research firm analyzes market share, retail activity, and prospects of major hearing aid manufacturers. July 3, 2013. Available at: http://hearinghealthmatters.org/hearingnewswatch/2013/research-firm-analyzes-market-share-retail-stores-prospects-of-major-hearing-aid-makers

- World Health Organization (WHO). Deafness and hearing loss. March 2015. Available at: http://www.who.int/mediacentre/factsheets/fs300/en

- Talk Android. Global smartphone unit sales forecast. Available at: http://www.talkandroid.com/95860-smartphone-sales-will-nearly-double-pcs-this-year-and-reach-1-5-billion-in-2016/global-smartphone-unit-sales-forecast

- National Institutes of Health/National Eye Institute. Facts about hyperopia. Available at: http://nei.nih.gov/health/errors/hyperopia

- Newport F. Forty percent of Americans who use glasses would consider laser eye surgery. Gallup. March 6, 2000. Available at: http://www.gallup.com/poll/3115/forty-percent-americans-who-use-glasses-would-consider-laser-eye-surgery.aspx

- American Academy of Audiology (AAA). Incidence of Severe and Profound Hearing Loss in the United States and United Kingdom. May 10, 2013. Available at: http://www.audiology.org/news/incidence-severe-and-profound-hearing-loss-united-states-and-united-kingdom

- Researchers discover brain reorganizes after hearing loss. May 20, 2015. Available at: http://www.hearingreview.com/2015/05/researchers-discover-brain-reorganizes-hearing-loss

- Hear well in a noisy world. Consumer Reports. July 2009:32-37. Available at: http://www.consumerreports.org.

- Abrams HB, Kihm J. An Introduction to MarkeTrak IX: A New Baseline for the Hearing Aid Market. Hearing Review. 2015;22(6):16. Available at: http://www.hearingreview.com/2015/05/introduction-marketrak-ix-new-baseline-hearing-aid-market

- Aarts NL, Caffee CS. Manufacturer predicted and measured REAR values in adult hearing aid fitting: Accuracy and clinical usefulness. Intl J Audiol. 2005;44:293-301.

- Aazh H, Moore BC. The value of routine real ear measurement of the gain of digital hearing aids. J Am Acad Audiol. 2007;18(8):653-664.

- Aazh H, Moore B, Prasher D. The accuracy of matching target insertion gains with open-fit hearing aids. Am J Audiol. 2012;21(2):175-180. doi: 10.1044/1059-0889(2012/11-0008).

- Abrams HB, Chisholm TH, McManus M, McArdle R. Initial-fit approach versus verified prescription: comparing self-perceived hearing aid benefit. J Am Acad Audiol. 2012;23(10):768-778.

- Hawkins D, Cook J. Hearing aid software predictive gain values: How accurate are they? Hear Jour. 2003;56:26-34.

- Kochkin S, Beck DL, Christensen LA, et al. MarkeTrak VIII: The impact of the hearing healthcare professional on hearing aid user success. Hearing Review. 2010;17(4):12-34. Available at: http://www.hearingreview.com/2010/04/marketrak-viii-the-impact-of-the-hearing-healthcare-professional-on-hearing-aid-user-success

- Leavitt RJ, Flexer C. The importance of audibility in successful amplification of hearing loss. Hearing Review. 2012;19(13):20-23. Available at: http://www.hearingreview.com/2012/12/the-importance-of-audibility-in-successful-amplification-of-hearing-loss

- Mueller HG. Probe-microphone measurements: 20 years of progress. Trends Amplify. 2001;5(2):3-39.

- Mueller HG. Probe-mic measures: Hearing aid fitting’s most neglected element. Hear Jour. 2005;57(10): 33-41. doi: 10.1097/01.HJ.0000285782.37749.fc

- Mueller H, Picou E. Survey examines popularity of real-ear probe-microphone measures. Hear Jour. 2010;63:27-32

- Mueller HG. 20Q: Real-ear probe-microphone measures—30 years of progress? January 13, 2014. Available at: http://www.audiologyonline.com/articles/20q-probe-mic-measures-12410

- Mueller HG. Siemens Expert Series: day-to-day hearing aid fittings—clinical nuggets from recent research. April 27, 2015. Available at: http://www.audiologyonline.com/articles/siemens-expert-series-day-to-13768

- Mueller HG. 20Q: Today’s use of validated prescriptive methods for fitting hearing aids – what would Denis say? April 27, 2015. Available at: http://www.audiologyonline.com/articles/siemens-expert-series-day-to-13768

- Palmer CV. Best practice: it’s a matter of ethics. Audiology Today. 2006;Sept-Oct:31-35.

- Taylor B, Cavitt K. Evidence-based hearing aid dispensing practice: Financial incentives for audiologists. January 14, 2013. Available at: http://www.audiologyonline.com/articles/evidence-based-hearing-aid-dispensing-11520

- Sanders J, Stoody T, Weber J, Mueller HG. Manufacturers’ NAL-NL2 Fittings Fail Real-ear Verification. Hearing Review. 2015;21(3):24. Available at: http://www.hearingreview.com/2015/02/manufacturers-nal-nl2-fittings-fail-real-ear-verification

- Valente M, Abrams H, Benson D, Chisolm T, Citron D, Hampton D, Loavenbruck A, Ricketts T, Solodar H, Sweetow R. Guidelines for the Audiological Management of Adult Hearing Impairment. Audiology Today. 2006;18. Available at: http://digitalcommons.wustl.edu/cgi/viewcontent.cgi?article=1001&context=audio_fapubs

- ADA asks HIA to retract comments on earVenture; says new firm in keeping with Academy’s mission, members’ goals. Sept 29, 2015. Available at: http://www.hearingreview.com/2015/09/ada-asks-hia-retract-comments-earventure-says-new-firm-keeping-academys-mission-members-goals

- Vasanth R. Apple Inc. (AAPL) Controls 42% Of The US Smartphone Market With Marginal Gain. Oct 20, 2014. Available at: http://dazeinfo.com/2014/10/20/apple-inc-aapl-samsung-005935-smartphone-market-us-growth-q3-2014

- Smriga D. Are we (still) asleep at the wheel? An update from seven years ago. Sept 12, 2011. Available at: http://www.audiologyonline.com/articles/we-still-asleep-at-wheel-809

- Representatives reintroduce Audiology Patient Choice Act. May 22, 2015. Available at: http://www.hearingreview.com/2015/05/representatives-reintroduce-audiology-patient-choice-act